Manila’s Housing Prices Have Risen First in the World

Manila’s Housing Prices Have Risen First in the World

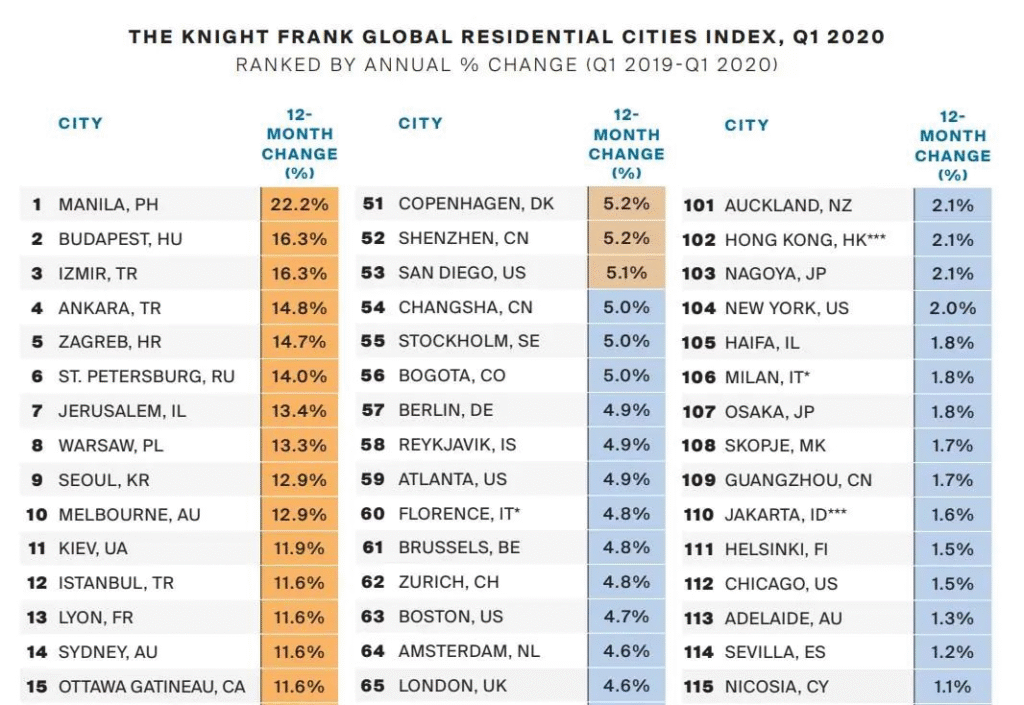

According to Knight Frank International’s latest house price index report, house prices in Manila, the capital of the Philippines, increased by 22% over a year ago, ranking first in the world in the Q3 of this year.

Manila’s housing price growth has also far shortened the gap with Seoul, South Korea, and the Australian capital cities. These cities have all achieved impressive growth in 2019, but none of them can compare with Manila. Most of the other countries and regions behind Manila are in Africa, Central and Eastern Europe and West Asia n. In contrast, Xi’an, China’s highest-ranked city, has experienced only half of the price increase in Manila in the past year.

The fundamental logic of the prosperity of the Manila property market is still the relationship between supply and demand. The supply is obviously not keeping up with the demand for the renewal of housing. Despite the fierce housing price increase, the housing prices in the popular BGC, Ortigas, and Pasay casino areas of Manila, the capital of the Philippines, are still only around USD 5000/m2, which is lower than the surrounding Kuala Lumpur and Bangkok, not to mention the first-tier cities in China.

However, it is worth noting that the latest data of this statistic is only as of the first quarter of this year, which is the end of March. At that time, it was the beginning of the global pandemic of the new crown epidemic, and countries have entered a state of lockdown.

The impact of the epidemic on housing transaction prices and transaction volume is not reflected in this report.

Therefore, in order to know the performance of the Manila property market during the epidemic and make predictions about future trends, they found monitoring reports from Colliers, Cushman & Wakefield, and Jones Lang LaSalle (JLL), and Related reports from local media.

At the beginning of the lockdown, sales of mid-range residential properties slowed slightly. Apartments have suffered a sudden weakening in demand because foreign buyers are reassessing, and local families have lost their past continuous remittances. The foreign employees also decided to return to their home country due to concerns about the border closure and terminated the house lease early.

Colliers International even predicts pessimistically that if the epidemic continues to the end of 2021, Manila house prices will fall by 15% and the second-hand apartment market will return to pre-sale levels. Colliers International reminds that special attention should be paid to the price reduction of mid-range apartments, such as units with a total price of 3.2 million Pesos (about 66k USD ) to 5.9 million Pesos (about 120k USD).

However, the price cut is not terrible in fact, this is generally caused by developers who take the initiative to discount or sellers who lack cash flow that rush to make a deal, especially when the global real estate market has been blocked by the epidemic.

What we want to know more is, when will the Manila property market recover or even rebound?

We still look at Colliers International’s forecast first. Their report pointed out that assuming that the Philippine government can control the epidemic from the fourth quarter of 2020, the property market will begin to slowly recover in 2021. After a possible fall of 15% in 2020, Colliers International predicts that Manila’s house prices will increase by an average of 1.7% between 2020 and 2022, which means there will be at least a 10% rebound next year.

Such a rebound is not uncommon in history. Previous crises have shown that once market sentiment and business activities begin to improve, prices will immediately recover.

During the Asian financial turmoil, house prices fell by 9% to 14% from 1998 to 1999, and then resumed growth in 2000, rising by 24%. The same trend occurred during the global financial crisis, when house prices fell by 1.5% in 2009 and then began to recover in 2010, rising by 2.1%.

And if we look at the specific transactions in the local market, Chinese investors are still key overseas buyers in the Manila property market, as in the past few years.

In the past few years, as Philippine President Duterte worked hard to restore relations with China and establish closer ties, Chinese buyers have always been the leaders in the Philippine real estate boom.

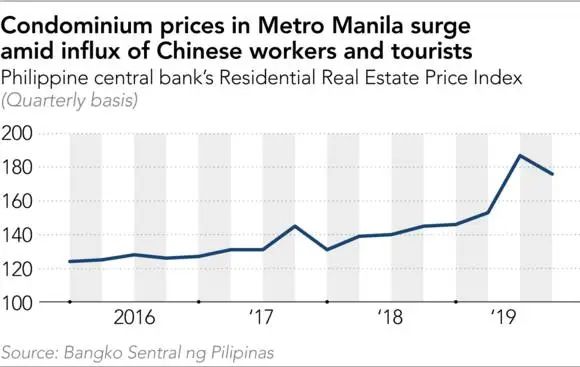

The real estate price index of the Central Bank of the Philippines shows that apartment prices in Metro Manila have risen by nearly 40% from the end of 2016 to the end of 2019. And these three years have coincided with the influx of Chinese buyers.

As a result, Ayala Land, the largest real estate developer in the Philippines, said that due to the blockade of China and the Philippines, sales to China fell by 49% in the first quarter of this year to 1.5 billion Pesos.

Nevertheless, Chinese buyers still account for 41% of Ayala Land’s international sales, making them the largest buyer.

According to the Nikkei Asian Review, a Chinese entrepreneur surnamed Ye who has owned nearly 100 apartments in Manila said: “After the epidemic, I will continue to buy Manila.”

This is inseparable from Manila’s strong investment attributes. According to the monitoring of Colliers International, before the epidemic, the average rental return in Manila could be more than 5%, higher than 4% in Bangkok and 3% in Singapore.

Moreover, according to information released by the world’s leading real estate company (LeadingRE), large transactions are still going on during the lockdown. For example, a Chinese group reached a 5.5 billion pesos (about 778 million yuan) transaction with them.

Salas, LeadingRE’s business director, said in an interview with the media: “It is obvious that Chinese buyers will stay here. As long as they can continue to fly (return to flight), they will continue to buy.”

Just like the Malaysia property market, as long as you dare to enter, now is a rare window period.

Bernstein International Consulting said that Manila’s demand for 6 million homes is still unmet, and real estate is still a reliable long-term investment.

“I attribute it to two Cs: certainty and confidence. The current reduction in activity between buyers and sellers is only temporary. When confidence is restored, housing demand will slowly rise, although it will not be like before the epidemic. So fierce. Because of lower interest rates and a slowing infection curve, more people will buy houses.”

For us, Savills’ prospects deserve attention. They pointed out in the latest report that low-income families will generally feel economic uncertainty, but those buyers in the mid-market still have the purchasing power.

The mid-market is converted into RMB, which is the price we often buy. These potential needs are exactly what developers need to address most at the moment.

Therefore, Savills expects that developers will provide 10% to 15% promotional discounts, especially for those prospective existing homes that are ready to be rented out. For investors who are willing to enter the market at a low price, the opportunity is here!